We are dedicated to helping our clients protect their wealth, minimize financial risks, and achieve their financial goals through comprehensive risk management and insurance solutions. Our team of experts is committed to providing personalized advice and guidance tailored to your unique needs and objectives.

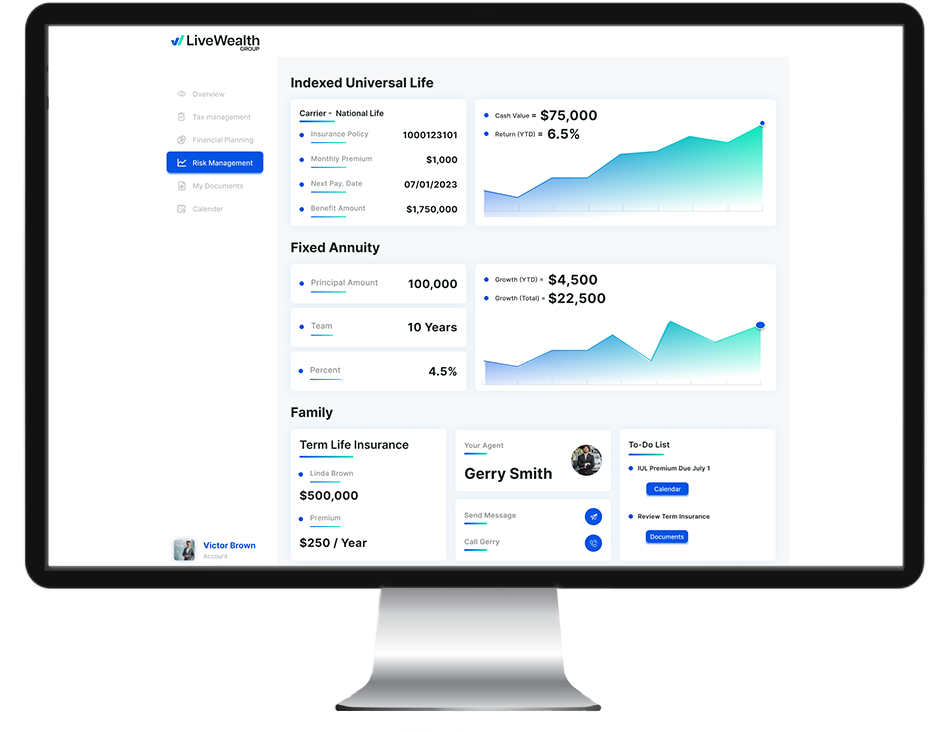

Our indexed universal life insurance products offer the dual benefits of cash value accumulation and death benefit protection. These policies provide you with the potential to grow your wealth based on the performance of selected market indexes while offering the peace of mind that comes with life insurance coverage.

Term insurance provides straightforward and affordable coverage for a specified term. It offers protection for a set period, such as 10, 20, or 30 years, ensuring that your loved ones are financially secure in case of your untimely passing

Our mortgage protection insurance safeguards your family's home by providing coverage that helps pay off the mortgage balance in the event of your death. This protection ensures that your loved ones can maintain their living arrangements and avoid financial strain during a difficult time.

Our team specializes in assessing and mitigating financial risks to protect your assets. We work closely with you to develop a comprehensive risk management strategy that safeguards your wealth and minimizes potential vulnerabilities

Imagine having the ability to access cash when you need it, without relying on traditional banking systems or facing exorbitant interest rates. With our insurance-based strategies, you can become your own bank and unlock the potential for greater financial freedom.

Through specialized insurance products such as indexed universal life insurance and whole life insurance, we offer a unique avenue for building wealth and creating a private banking system that works in your favor. Here’s how it works:

Our insurance policies provide a cash value component that grows over time. As you pay premiums, a portion of those funds is allocated to the cash value, which can grow tax-deferred and potentially even earn returns based on market performance.

Insurance-based strategies provide potential tax advantages. The growth of the cash value occurs on a tax-deferred basis, meaning you won't pay taxes on the gains as long as the policy remains in force. Additionally, policy loans are often tax-free, allowing you to access cash without triggering immediate tax liabilities

The cash value in your insurance policy serves as a financial resource that you can access during your lifetime. It offers flexibility and liquidity, enabling you to borrow against it for various purposes such as funding investments, starting a business, or covering unexpected expenses.

Alongside the financial benefits, our insurance policies also provide death benefits that offer protection for your loved ones. In the event of your passing, the policy ensures that your beneficiaries receive a payout, helping them maintain financial stability during a challenging time. By using insurance as your own bank, you can break free from the limitations of traditional banking systems and embrace a more empowered and flexible approach to managing your finances.

We are committed to delivering personalized risk management and insurance solutions that align with your financial goals. Contact us today to schedule a consultation and discover how our comprehensive offerings can help protect your wealth, secure your future, and provide peace of mind for you and your loved ones.